“Fintech, money, finance” by Tech in Asia is licensed under CC BY 2.0.

Cash Flow Projections for Funding & Management

Funders like banks and investors require financial projections including a Cash Flow Statement that demonstrates how much cash you will have on hand based on funding, income and expenses. For small asks, you can rely upon past year accounting records to substantiate cash management. But what if you’re funding a huge growth spurt? Or what if your company just went through a multi-year downturn like a pandemic or a flood? Or what if your nonprofit is applying for a grant for a new program? All of these circumstances are outside the realm of historical accounting records and require financial forecasting techniques.

What is a cash flow statement?

The cash flow statement is a financial document that shows the cash inflows and outflows of a business over a certain period. The term “cash” refers to money that has been received by, or paid out from an entity (such as a company) during one year’s time—not including interest payments or dividends paid out by shareholder companies. You’ll also see how much money was spent on goods or services that were sold during this period (revenue), as well as what kinds of expenses were incurred along with revenue (expenses). These figures are important to calculate your net income—the amount left over after all expenses have been paid for.

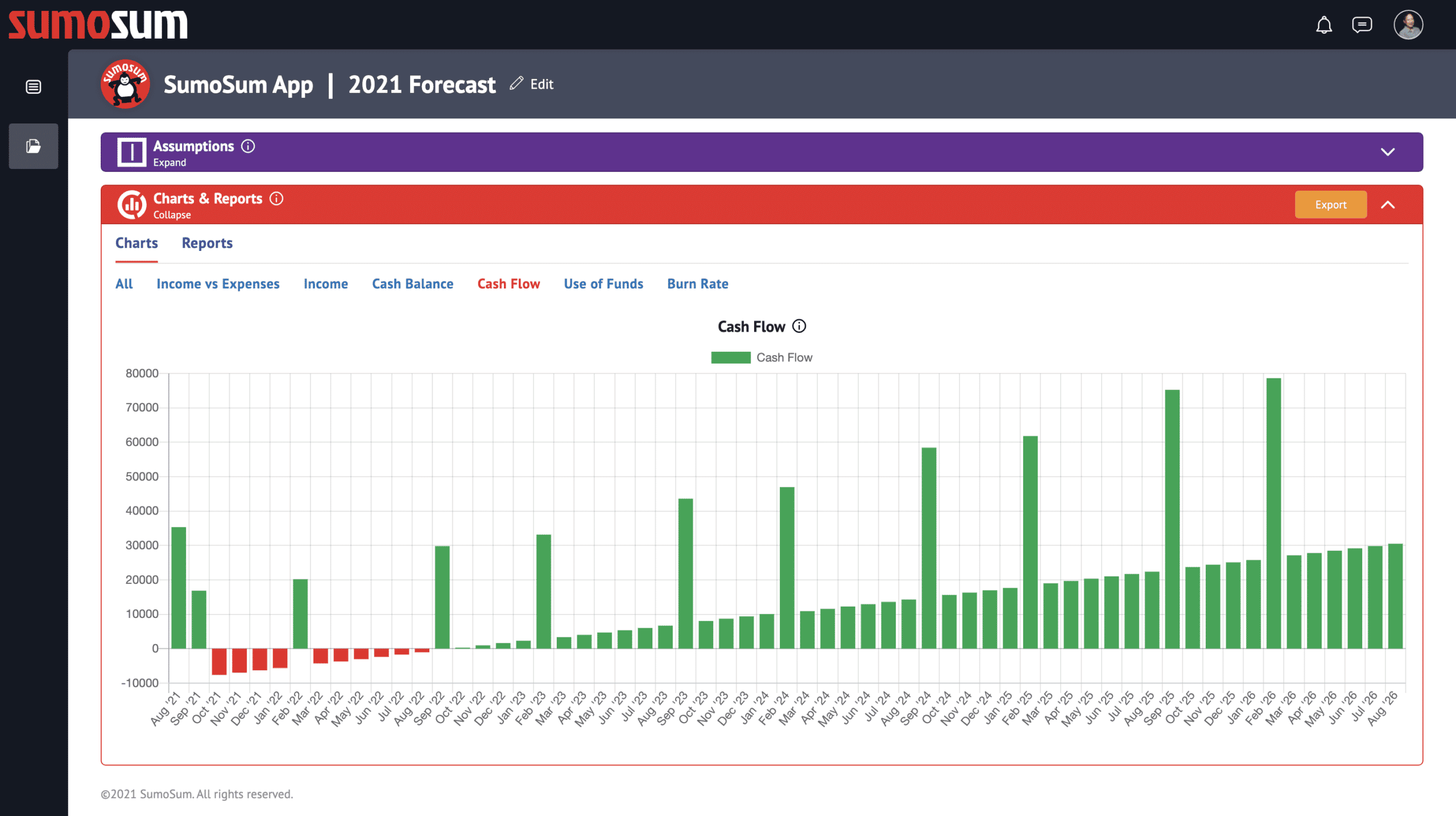

Cash flow statements made easy

Entrepreneurs are more focused on developing their products than crunching the numbers. So how do you begin to forecast your cash flow statement? With SumoSum, once you create your project, you are greeted with an “assumptions panel” that prompts you to input the necessary information to generate your statement, such as your starting date, opening cash balance, income tax percentages, etc. Let’s say along the way, you run into an entry such as “annual dividends percentages” and you don’t quite know what that is; well, don’t worry! SumoSum has just-in-time pop-ups to give you tips and answers to all of your questions. After you’ve successfully plugged your numbers into the assumption panel, you can “trend” your data to forecast your income and expenses months ahead, while propagating your dashboard with additional data such as unit prices or monthly volumes by simply selecting the option. To further enhance your statement, you can also include footnotes and comments to collaborate with your team as a multi-user functionality. Lastly, as you continue to plug in your numbers, SumoSum automatically generates your visual charts and statements in real-time. If you require charts for a financial packet or perhaps a pitch deck, you may simply download and apply your visual models however you choose.

Create your Cash Flow Statement with SumoSum

With SumoSum, you don’t have to be an MBA or accountant to create a professional budget or financial forecast. SumoSum was created as a multi-user platform that automates and simplifies the financial forecasting process. You and your team can begin to create a free, fast and easy cash flow statement. Sign Up, FREE! »