“#finance #personal-finance #banking #saving“ by Lemon Loco Designs is licensed under CC BY 2.0.

Let’s begin by explaining what a sales on credit percentage is – it’s a critical metric for any business that sells products or services on credit terms. It represents the percentage of sales revenue that a company has made on credit, compared to the total sales revenue generated. This metric is essential for assessing the company’s ability to manage its cash flow, evaluate its credit risk, and understand the financial health of the business. However, it also comes with risks, such as customers defaulting on payments, delayed payments, and cash flow issues. By tracking the sales on credit percentage on SumoSum, companies can evaluate the effectiveness of their credit policies and make informed decisions to mitigate these risks.

Why should an entrepreneur care about sales on credit percentage?

An entrepreneur should care about the percentage of sales on credit because it directly affects their cash flow and profitability. When a business sells products or services on credit, it means that they are extending payment terms to their customers, and they may not receive payment for those sales for a certain period of time. This can create a gap between the time the sale is made and the time the payment is received, which can impact the business’s cash flow.

If the percentage of sales on credit is too high, it can put a strain on the business’s cash flow and make it difficult to pay bills or invest in growth opportunities. Additionally, if customers are not paying their bills on time, it can lead to bad debt write-offs and other financial losses.

Therefore, by monitoring the percentage of sales on credit and implementing strategies to manage credit risk and improve collection processes, entrepreneurs can improve their cash flow, reduce bad debt, and increase profitability.

The benefits to forecasting your businesses sales on credit percentage

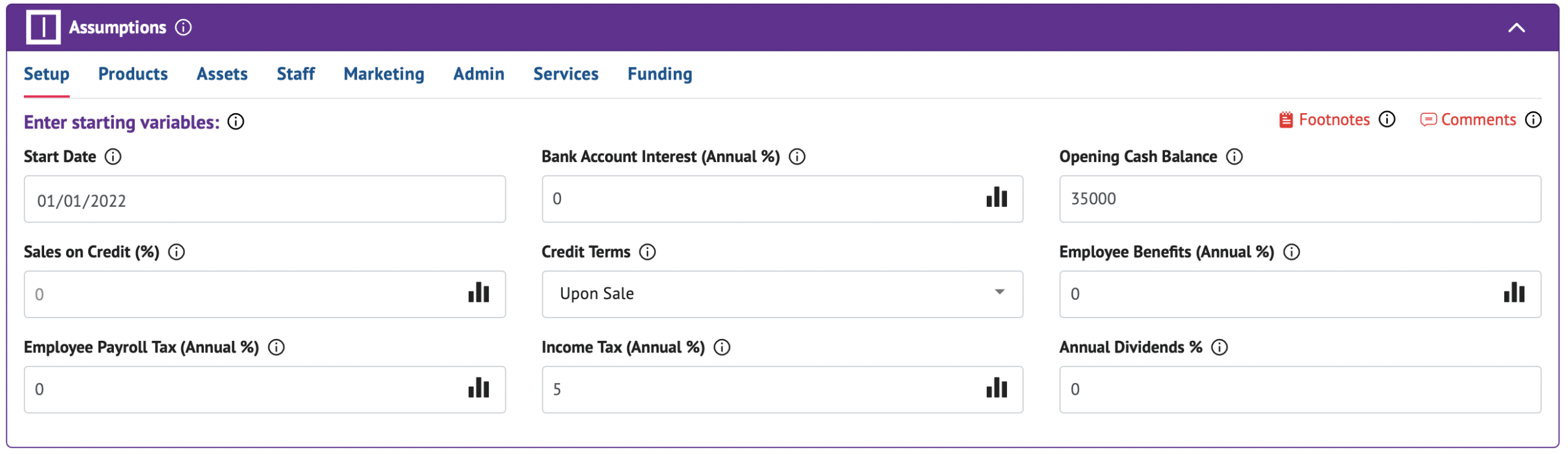

SumoSum tracks 8 general forecasting variables to deliver comprehensive financial statements. One of the main benefits of tracking the sales on credit percentage is that it allows companies to assess their credit risk. If the percentage is high, it may be an indication that the company needs to implement stricter credit policies or improve its credit management practices to reduce the risk of bad debts. Conversely, a low sales on credit percentage can be an indication that the company is missing out on sales opportunities and may need to consider offering more flexible credit terms to attract customers.

Another benefit of tracking the sales on credit percentage is that it can help companies manage their cash flow. When a company sells products or services on credit, it may not receive payment for several weeks or months, depending on the credit terms offered. This can create cash flow problems if the company does not have enough cash reserves to cover its expenses in the meantime. By tracking the sales on credit percentage, companies can estimate how much of their sales revenue will be received on credit and plan their cash flow accordingly.

Let SumoSum remove the stress from forecasting

Overall, sales on credit percentage is a critical metric for any business that sells products or services on credit terms. With SumoSum, you don’t have to be an MBA or accountant to create a professional budget or financial forecast. SumoSum was created as a multi-user platform that automates and simplifies the financial forecasting process. You and your team can begin to track all the necessary forecasting variables under one platform, it’s free, fast and easy!. Sign Up, FREE! »