“Piggy Bank” by free pictures of money is licensed under CC BY 2.0.

Why a Future Profit and Loss Statement?

Forecasting a future profit and loss statement is key to gaining investor interest, particularly for early-stage and startup businesses that don’t have profitable historical accounting data. Investors are interested in the bottom line profitability of a business concept, which is what a profit and loss statement defines. If you don’t have much profitable track record to show, then doing a profit and loss forecast as a future projection of profitability is the way to go.

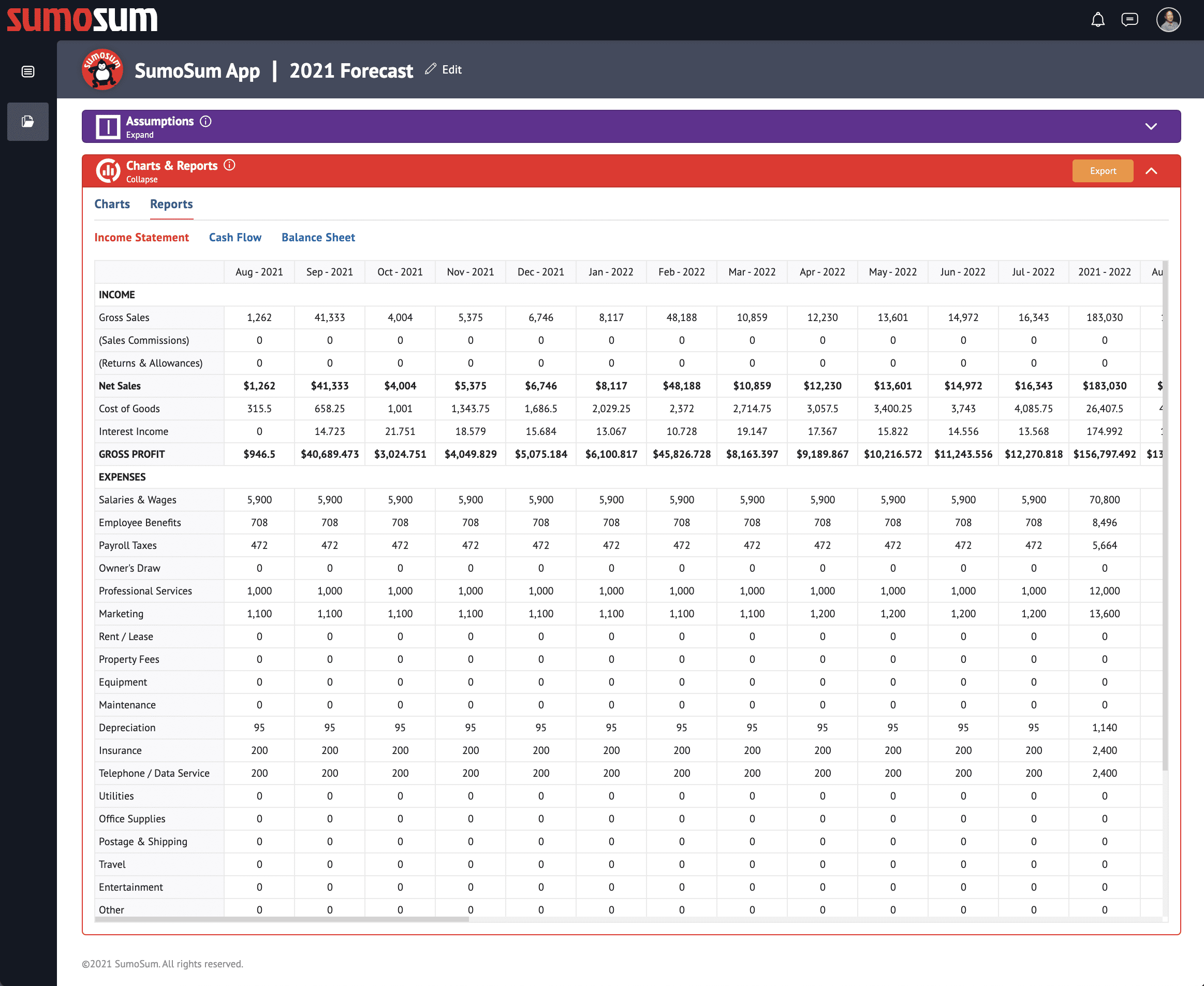

Keys to Reading a Profit and Loss Statement

A P&L statement is a financial report that illustrates the bottom line profitability of a company. You may often hear this term used interchangeably as an income statement or most commonly abbreviated as a P&L statement. This report details a company’s net income, revenue and expenses through a specific period of time often reported quarterly, annually and sometimes even monthly. From an investor’s point of view, key line items to keep in mind when constructing a P&L statement:

- Revenue: A P&L starts with a company’s revenue from sales. Depending on the type of business, income can derive from sales commissions, returns and allowances, and may even be categorized by in-store or online sales.

- Cost of Goods Sold: Costs of Goods Sold (aka COGs) are expenses attributable to making goods such as materials, transportation and other costs necessary to the production of goods.

- Gross Profit: Gross Profit is calculated by simply subtracting COGs from Revenue.

- Operating Expenses: These are “overhead” expenses necessary to operating a business outside of COGs. Operating Expenses include marketing, property leases, professional services, utilities, travel, insurance, legal, bookkeeping, payroll and other costs.

- Net Profit or Loss: Net Profit is calculated by subtracting Operating Expenses and taxes from Gross Profit. If the calculation yields a negative number, then the company has a net loss. These calculations are the bottom line of your company and investors are looking for companies with either a consistent record of net-profits or promise of net-profits based on long-term forecasts.

Forecasting a Future Profit and Loss Statement

Begin forecasting a P&L statement for the future without having to record receipts. Simply use our template to estimate what your future expenses or income will be by creating new lines in the corresponding section. Our automated calculations will generate your gross profit, net loss or net profit. As quickly as it is to begin, you will have your P&L statement ready to present to your investors. There’s no time to start from scratch, create a free account to begin, no credit card required. Sign Up, FREE! »

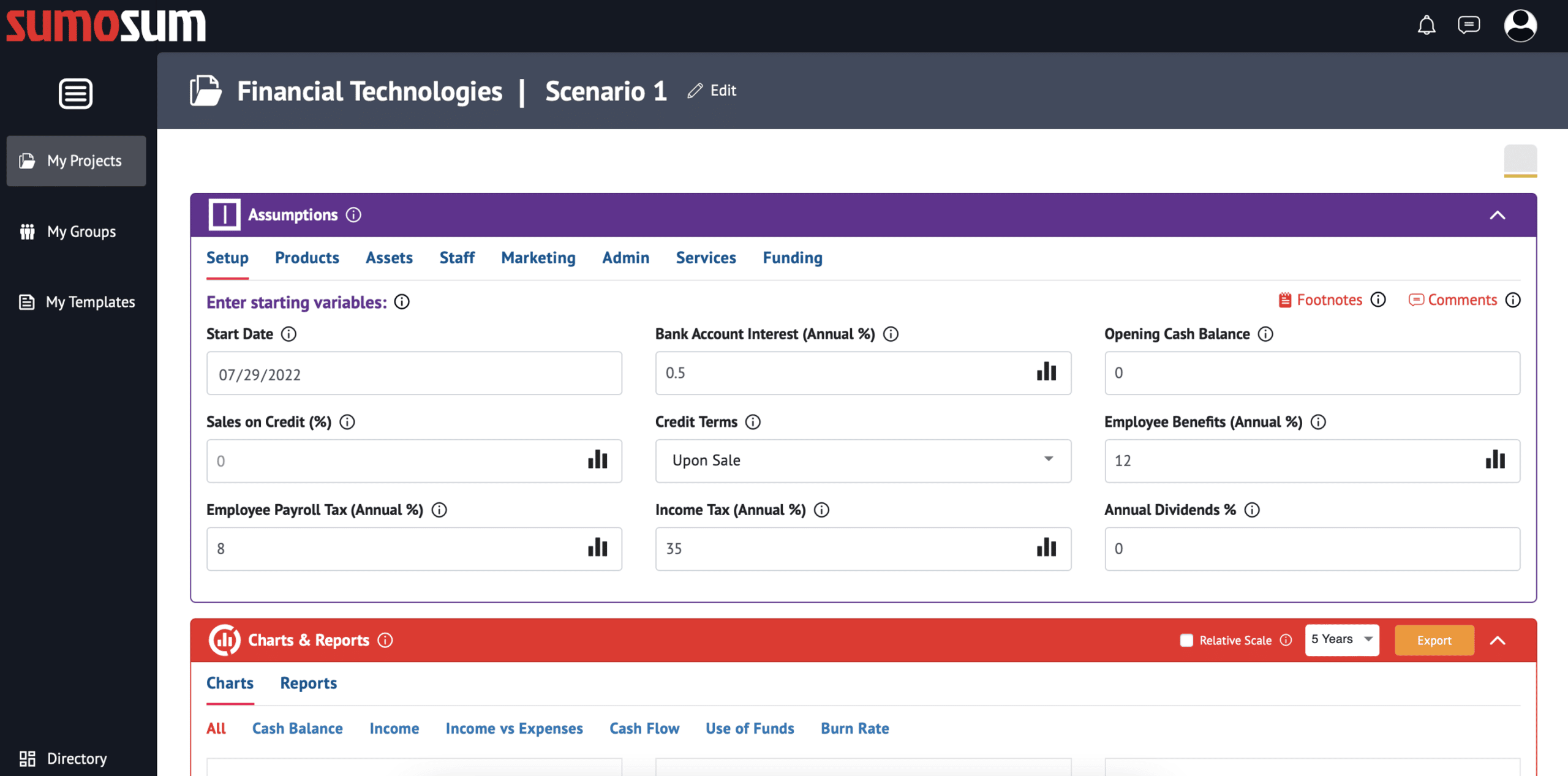

Profit and Loss Forecast Charts & Graphs

P&L reports are pretty dry spreadsheet documents that lay people have a hard time understanding. So translating it into visual charts and graphs is key to making the content understandable and engaging to investors.