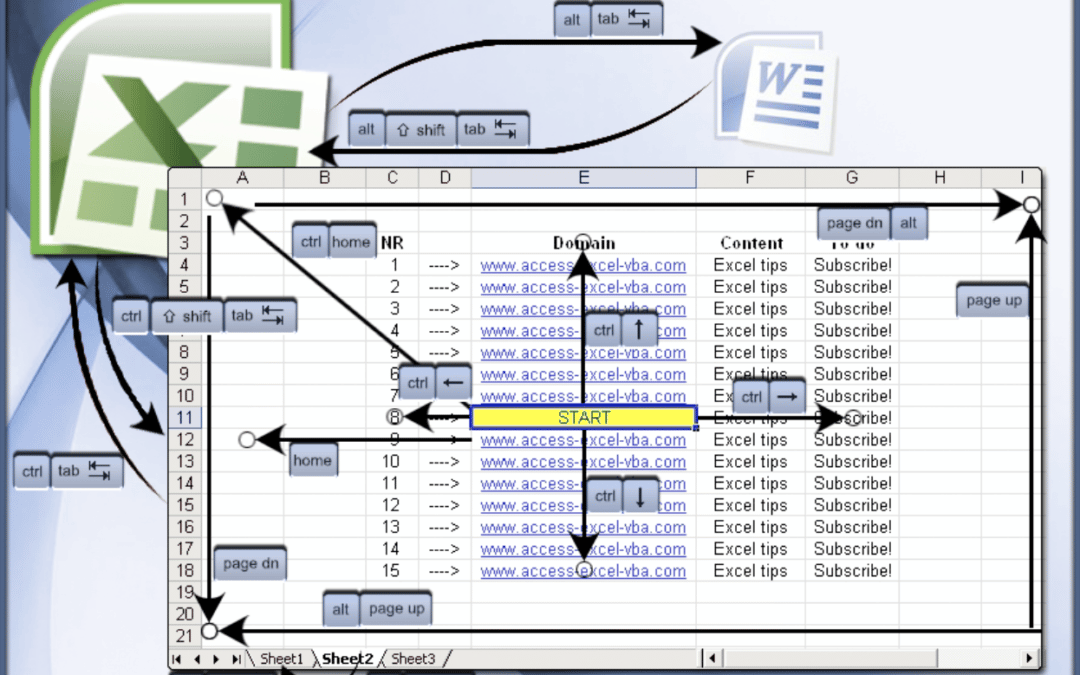

“Excel & OpenOffice Calc navigation shortcuts” by Till Zoltán is licensed under CC BY-SA 2.0.

Excel is NOT the Solution for Financial Forecasting

While spreadsheets are the top-of-mind tool for crunching business numbers, unless you’re part accountant, an absolute wizard at Excel and have graphic design skills, Excel for financial forecasting falls short for business decision making. Here’s why:

1. Charts and graphs are not included

One of the biggest downfalls of Excel is that charts and graphs have to be manually programmed. This means that you have to know the types of reports to generate, how to program them into Excel and how to create pleasing graphics that communicate accurately. In short, to create charts and graphs, you need to be part CPA, part computer programmer and part graphic designer.

2. Algorithms are easily broken

Excel spreadsheets are live documents that multiple users can “break.” Embedded spreadsheet formulas are often inadvertently broken when users cut and paste content. Further, forecasting formulas like compounding interest rates, depreciation/amortization and the flow of data from one report to another (e.g., Income Statement numbers flowing to Cash Flow Statement, then onto Balance Sheets) are complicated on Excel. Worse yet, users may not be aware of broken formulas and not be able to track down how to repair them.

3. Version control is uncertain

Excel as a file format makes it hard to know that you’re working on the latest version of a project. This is especially true when multiple users of a document collaborate on a spreadsheet together.

4. Excel isn’t a strong collaboration platform

Excel does not offer concurrent multi-user editing as only one user at a time can work on an Excel file. This means potential conflicts of user content and version control issues. It also limits processes that are better done by multiple minds at once. Further, while Excel has comment features, they are rather limited and not that intuitive to operate.

5. High chance of data loss and security breach

While Excel allows the locking of cell content, few people take the time to use this feature, thus data and formulas are generally open and subject to being deleted or copied over. Content locking becomes even less useful in multi-author circumstances as all users would have to know locking passwords and how to lock/unlock cells. Further, Excel files can be easily sent to others, thus any data is generally subject to security breach (there is a document password feature, but it is rarely used).

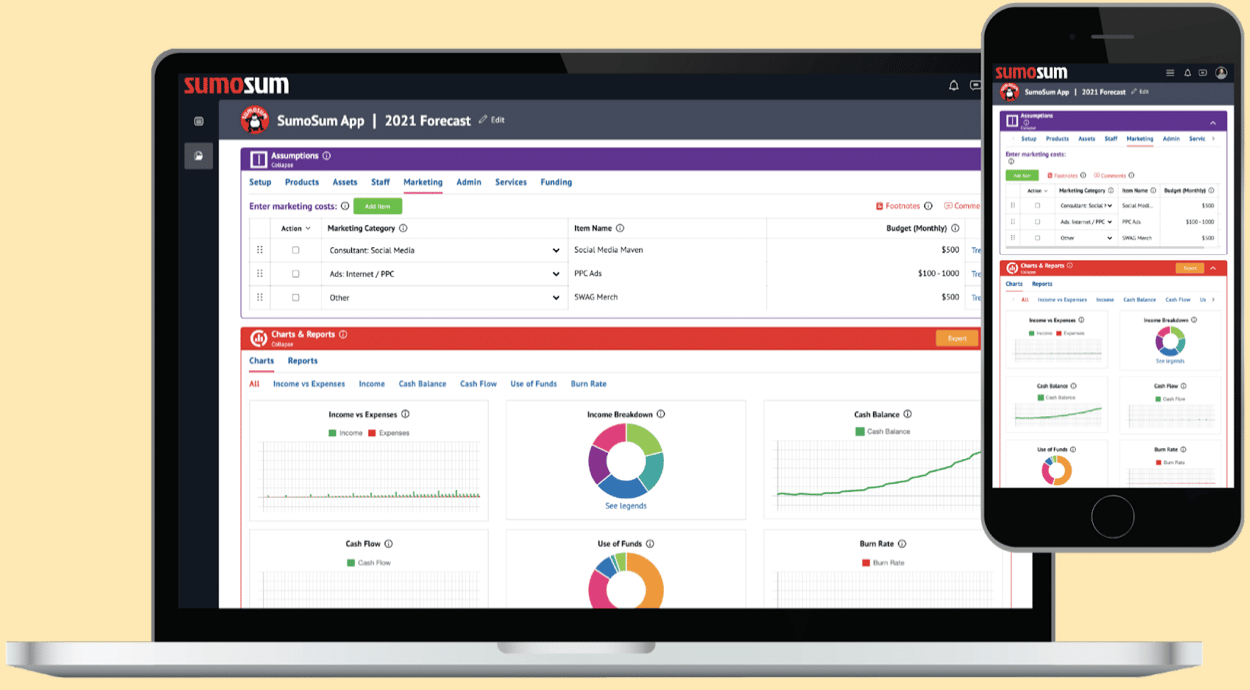

SumoSum as an Alternative to Excel for Financial Forecasting

SumoSum was created as a multi-user platform that automates and simplifies the financial forecasting process. It’s free, fast, easy and fun. Yes, fun. With SumoSum, you and your team will visually sculpt your hockey stick to success. Sign Up, FREE! »